does doordash do quarterly taxes

This means that as a DoorDash driver youll file taxes and report income on your own. US tax perspective-If you dont file taxes for DoorDash the same thing happens that would if you did not file taxes for any other income stream.

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Do you pay taxes on Doordash tips.

. Then I adjust it at end of year to more or less miles as. Do I Have to Pay Taxes for DoorDash. Instructions for doing that are available through the IRS using form 1040-ES.

DoorDash also said in 2019 that the average DoorDash driver can earn around 1850 per hour. Federal income taxes apply to Doordash tips unless their total amounts are below 20. Eventually the IRS will send you a notice and.

DoorDash does not take out withholding tax for you. I personally keep a mile log in notes on my phone. What Tax Forms Will DoorDash Send Their Drivers.

Doordash will send eligible drivers. Up to 8 cash back At DoorDash we promise to treat your data with respect and will not share your information with any third party. You only file your taxes once a year like anyone else.

Well You estimate the taxes that will be owing on your earnings. Does DoorDash Take Out Taxes. The short answer is yes.

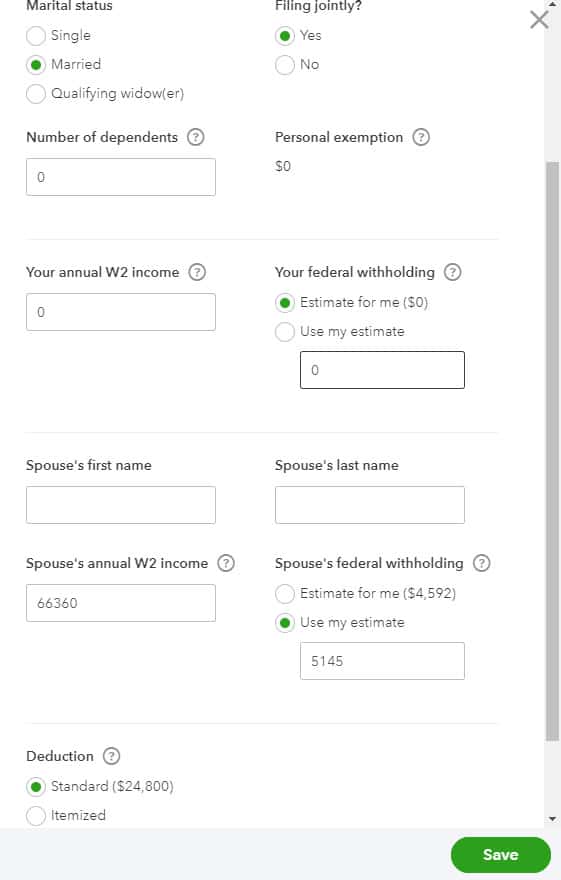

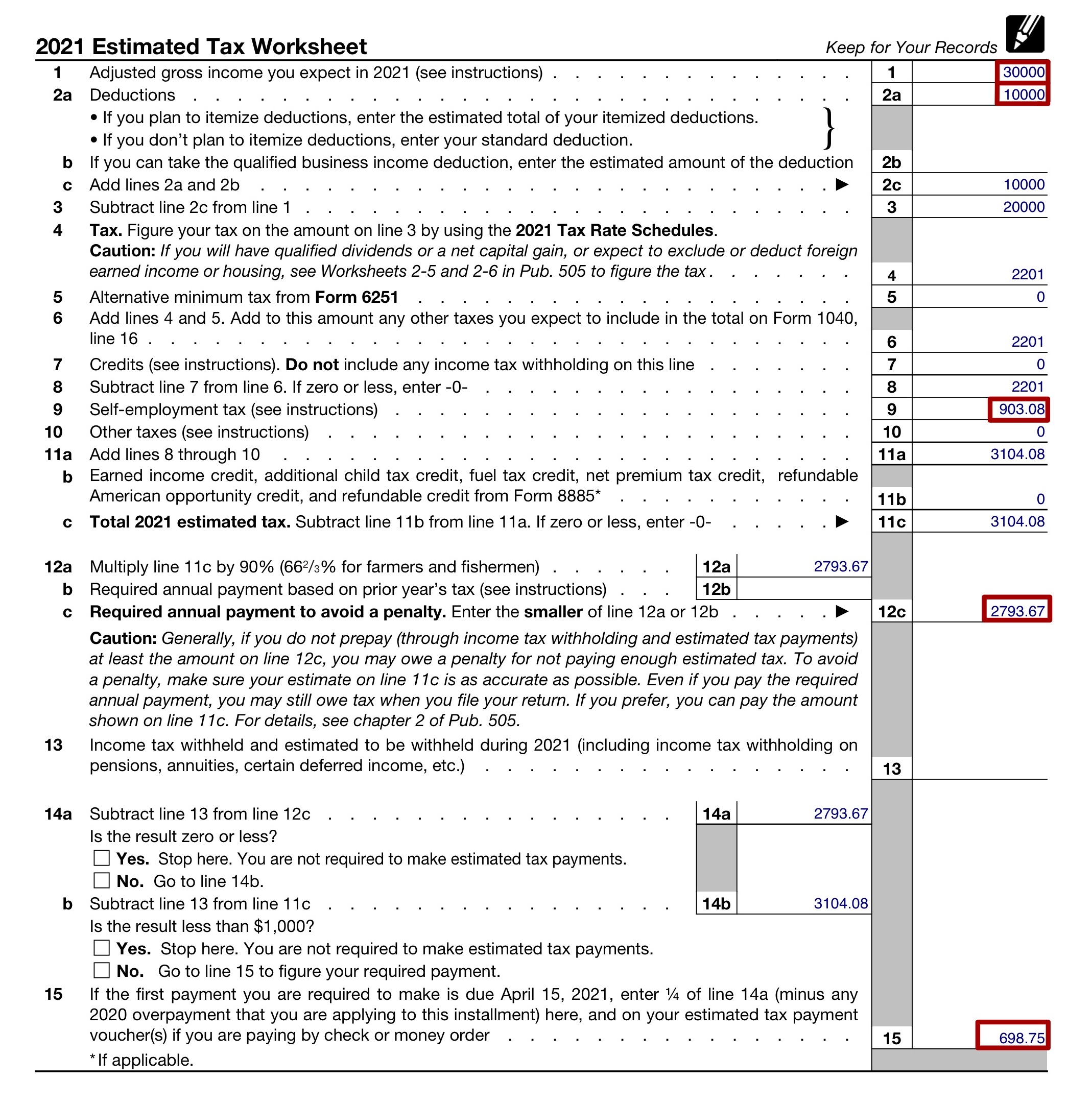

Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. You can also use the IRS website. You do PAY quarterly taxes if you expect to owe more than 1000 in taxes by the end of the year.

If youre a Dasher youll need this form to file your taxes. One of the most common questions Dashers have is Does DoorDash take taxes out of my paycheck The answer is no. Internal Revenue Service IRS and if required state tax departments.

Add up all of your income from all sources. This way i decide how many miles i went a day if you get my drift. How do Dashers pay taxes.

As an independent contractor the responsibility to pay your. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash. No because Dashers are not employees DoorDash does not withhold FICA taxes from their paycheck.

There are four major steps to figuring out your income taxes. Do you owe quarterly taxes. Yes - Cash and non-cash tips are both taxed by the IRS.

When you work as an employee your job withholds income taxes from your paycheck and submits them to the. You do not FILE quarterly taxes. Reduce income by applying deductions.

Answer 1 of 4. Dashers should make estimated tax payments each quarter. The forms are filed with the US.

A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. Instead Dashers are paid in full. If youre purely dashing as a side hustle you might only have to pay taxes one a year.

Since youre an independent contractor you might be responsible for estimated quarterly taxesespecially if DoorDash is your sole source of income. If Dashing is a small portion of your income you may be able to increase your income tax withholding at your day job instead of paying quarterly taxes. If you wait until April to pay you could have to pay a penalty if you owe.

If you expect to owe the IRS 1000 or more in taxes then you should file. It may take 2-3 weeks for your tax documents to arrive by mail. You can unsubscribe to any of the.

Paper Copy through Mail. Calculate your income tax.

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

When You Deliver With Ubereats Or Doordash How Do You Track Your Mileage For Taxes Do You Paper And Pen It Or Use An App What App And Do You Pay Fees

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Does Doordash Do Taxes Taxestalk Net

A Beginner S Guide To Filing Doordash Taxes 4 Steps

How Do I File Doordash Quarterly Taxes Due Septemb

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

How Do I File Estimated Quarterly Taxes Stride Health

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash How Much Should I Set Aside For Taxes Youtube

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras